What Exactly is a Credit Score?

/Credit Scores are sort of a funny thing amongst the general population. Most people I know if you were to stop them on the street and ask them about credit scores they will understand that credit scores exist, and that the higher the number the better, but beyond that, don’t really know much about them.

I was joking with a friend of mine the other day who is in the personal health business. We both came to the conclusion that credit scores are much like calorie counts on food labels. There is a vague knowledge that both exist and that we should pay attention to them, but their meaning and what exactly they are measuring is filled with misconceptions and a whole lot of bad information.

What Is A Credit Score?

So to get technical for a moment, let’s first just get the official definition of a credit score out on the table. A credit score is a numerical expression based on a level analysis of a person’s credit files, to represent the creditworthiness of an individual. Lenders use credit scores to determine who qualifies for a loan, at what interest rate, and what credit limits.

Opinions will vary a bit from financial institution to financial institution, but to simplify matters, a bad credit score will be anything below 600. A good credit score will be anything from 600 to 700. An above average or even great credit score will be anything from 700 on up! The maximum numerical value one can have for a credit score is 850.

How Is My Credit Score Determined?

Understanding how your credit score is determined is essential if you want to improve that number. This I find is where most of the misconception out there takes root. Everyone out there seems to have an opinion on this and everyone seems to have advice on how to raise credit scores quickly. Unfortunately, most of that advice is bad.

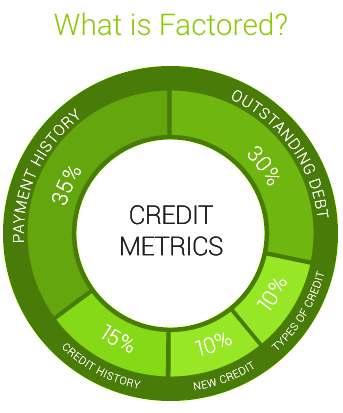

Take a look at this handy chart…

It looks a little bit complicated I won’t deny, but this is a great representation of what is considered and factored in when determining your credit score. Not surprisingly, the two biggest pieces of the pie by far are payment history and outstanding debt. In other words, the two items that are going to make your credit score go up and stay up are paying your bills on time, and keeping the amount of money you borrow down to a minimum. Even more importantly, you want to keep you revolving credit down to a minimum. In other words, credit that comes from credit cards or other unsecured sources with fluctuating limits.

What Do I Do With This Information?

It is always a good idea to know what your credit score is. Always. It’s amazing to me how many people are afraid to find out what their credit score number is fearing for the worst. Fortunately it is easy to find out and there are a number of free websites where one can find this information. I recommend Credit Karma but it is really up to you who you ultimately use. Depending on what you find out there are a number of things you can do to either improve your credit score or keep it as high as possible. I’ve written another article on this subject which you can find HERE. I highly recommend giving it a read for some very simple steps to climbing your way out of a bad credit situation.